On July 19th this year Agênica Nacional do Petróleo, Gás e Biocumbustíveis (ANP) published the new model concession contract for exploration and production of petroleum and natural gas. The model was used for Brazil`s fourteenth bidding round, which was concluded on September 27 and contains amendments to the existing local content requirement, which seems to have resulted in renewed interest in the untapped resources of South America`s largest oil and gas producer. Out of the 287 blocks made available for public bidding, a total of 37 blocks were awarded, both offshore and onshore. In light of the previous thirteenth bidding round (not receiving any bids from major IOCs), it seems quite clear that the changes proposed by ANP are welcomed by the industry.

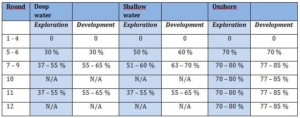

Besides the recent years` corruption scandal, one of the main challenges for the Brazilian oil and gas industry has been the authorities` rigid local content requirements. Concessionaires are required to make use of a certain percentage of Brazilian goods and services when performing exploration and development operations. As of 2005 (the 7th bidding round), these requirements gradually became more extensive and complex. An applicant`s proposal for fulfilment of these local content requirements has also been decisive, as the proposal has been considered when awarding new exploration and production areas.

Committing to a pre-determined and specific fulfilment of both exploration and development at the time of award represents significant economic risk for a concessionaire. Until exploration wells and other assessments have been completed, it is difficult to predict the extent and choice of technology, capital and competence required to develop and operate an oil or gas deposit. In addition, the non-fulfilment of local content requirements have been penalised with substantial fines. These factors have, amongst others, contributed to increase uncertainty and financial risk associated with Brazilian oil and gas operations.

Quality, competence and prices are unpredictable in Brazil. This also applies for the ability to deliver on time. Goods and services necessary to satisfy requirements are often unavailable, and where local content requirements can be met, it will often entail a higher cost than necessary for concessionaire. Also, the possibility of waiver (isenção) from the requirements has been marginal. As a whole, the local content regulation has made it more difficult to carry out ongoing oil and gas projects, as well as reduced commencement of new projects. In 2012, 232 exploration wells were drilled and 173 declarations of commerciality was submitted. In 2017, 5 such wells were drilled and 1 declaration of commerciality was submitted. During the current decline in oil prices, the requirements contribute to making Brazil less competitive compared to other oil and gas producing jurisdictions.

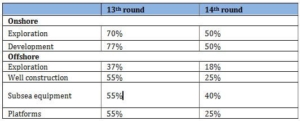

In the fourteenth bidding round, as well as the third round for production sharing in the Pre-salt Areas and fourth round for marginal accumulations, the authorities have decided to reduce local content requirements, possibly mitigating some of the current challenges for concessionaires in Brazil. The concession contracts for marginal accumulations no longer contain local content requirements.

Where the previous exploration and production concession contract contained specific requirements for specific tasks, installations, equipment etc., the requirements in the new model are split in five categories (two categories for onshore operations and 4 categories for offshore operations, where one of the categories apply for both type of operations);

- Exploration (onshore and offshore);

- Development (onshore);

- Well construction (offshore);

- Sub-sea installations (offshore); and

- Platforms (offshore)

The minimum requirements are substantially reduced compared to previous rounds. Further, the fulfilment of these requirements is longer part of the bid evaluation process.

ANP have explicitly communicated the intention of the proposed changes; to attract new investments to the Brazilian oil and gas industry. Also, the authorities have published a new regulation, which if enacted will grant concessionaires under existing concession contracts the opportunity to opt for the new local content regime, or remain in the current regime with extended possibility of applying for waivers. The regulation is currently subject to public consultation.

As the 14th bidding was recently concluded awarding 37 concessions – 10 of which was awarded to ExxonMobil – it seems clear that the regulatory changes made by authorities in relation to local content as well as the previous extension of the Repetro tax regime with 20 years, have managed to attract the attention of major international players. Should the 2nd Bid Round with 10 qualified applicants and 3rd Bid Round with 14 qualified applicants for the Pre-Salt areas, which are expected to take place on October 27, prove to be a success the Brazilian oil and gas industry seems to be well on the way to recovery.